[00:00:00] Foreign.

[00:00:05] You're listening to casual talk radio where common sense is still the norm whether you're a new or long time listener. We appreciate you joining us today. Visit

[email protected] and now here's your host, Leister.

[00:00:21] We need to talk money. And I don't suggest that I have every answer. I don't suggest that I am an expert, I don't suggest that I am a resident guru, and I don't suggest that you avoid a proper financial specialist when I say we should talk money.

[00:00:41] I want to talk about things that you and I can talk about safely because they're things you already know.

[00:00:49] All I'm doing is calling them back to light so. So you can think about it. Because for all we know, you know, I might not be long for this world. I might be gone.

[00:00:59] And I want to. I'm using this as kind of that outlet to document, to put pen to paper without paper because I've never scripted. I wanted to use this as an opportunity to share these things that spin through the head. You, you might not understand. You're like, why are you talking doom and gloom? I actually had my second girlfriend ask that question when I called her out of the blue to check on her for Covid.

[00:01:28] She was saying, oh, it's doom and gloom. You're saying you got to kill yourself. No, it's not that. But we ought to be realistic. Nobody lives forever and who knows?

[00:01:37] Because we don't know.

[00:01:39] You want to try to contribute as much as you can before whatever does happen happens. And that whatever could be anything, it could be literally anything. There's so much going on in the world, it may not be something that is in your control.

[00:01:53] Right?

[00:01:54] Death is not in your control. If you didn't know. Mike McCallum, boxer, Hall of Fame boxer, one of the greatest to do it, passed away. He had a heart attack. Driving, had a heart attack. He started feeling ill. Turns out it was a heart attack. We didn't know that time, but he started feeling ill, pulled over to the side of the road. There are stories about people who have heart attacks and, you know, whether pilots or driving, and they cause wrecks, right? They lose control. So he had the wherewithal to pull over at least, and he had passed away on the side of the road. It was bad enough that by the time they got there, it was already too late and there was nothing they could do. But this is a hall of fame boxer, somebody that trained, did nutrition the greater majority of his life. He was headed to the gym because he trains other. He was training other guys and just passed away. It just happened random sudden. My brother in 2023 passed away. I have questions about the circumstances, but there's nothing I could do about it.

[00:02:49] Then there's other situations that have nothing to do with death.

[00:02:52] There was a believer, a boxer, 30 something years old, diagnosed with ALS. I actually knew somebody that I used to work with. He was diagnosed with als. I was told this after the fact. I didn't know. I was told by somebody else, this is a person that was full of life. He was a energetic type of. He was very educated, very well spoken.

[00:03:14] He was one of the ones responsible for my growth.

[00:03:19] And I was told after the fact he had been diagnosed. So ALS is another thing. There was a gal, she went in for a tonsillectomy, routine tonsillectomy, passed away.

[00:03:30] We hear stories about pregnancy and complications during pregnancy that result in deaths. There's. There was a young gal, went in for, I believe it was something pancreas related. It was something that was, you wouldn't expect and then passed away.

[00:03:47] So I'm not trying to doom and gloom, it may sound like it. I'm not. I want to just simply level set that we can't control a lot of this stuff, right? And then there's things you can control but you don't know, something that comes back to bite you or something that's just false or something that happens and you just can't. You might be able to control it, but you don't know about it till it's too late and then you lose control.

[00:04:08] You know, let's say you lose a job or something, right? There's all sorts of things.

[00:04:12] So this I'm simply breaking down is the reason why I do the show is to share things that go through my head because it may come a point where I'm not able to for whatever that means.

[00:04:25] Hopefully not. I'm, let's say cautiously optimistic. Back to money. Because I've been ranting for five minutes. Back to money.

[00:04:35] Inflation has caused the vast majority of us to struggle financially and has been the case for years. This is not a new arrival. It's been the case for years and the government's trying to do stuff to fix it, but we don't know how long it's going to take. It's probably going to take a long time and in the short term we kind of have to just work it as best we can.

[00:04:56] There's a lot of chatter around the vaccines and the, you know, Robert Kennedy Jr. He recently came out, said, you know, we're removing Covid from the recommendation schedule for shots for certain populations. And some people aren't happy about that.

[00:05:16] I'm a My Body, My Choice fan, and I extend that beyond abortion.

[00:05:22] I believe that people should be able to make their own decisions and live with the repercussions of those decisions. I think that the last thing I want is government trying to protect me from things that may or may not be harmful.

[00:05:39] We see this actually in Texas, they started doing more screening because they're trying to keep young people from accessing adult, you know, erotica stuff.

[00:05:50] So what they're doing to try to do that is these companies are basically prompting every time to do like a kyc, you know, upload your ID and do all this scan. Well, that's a privacy breach.

[00:06:02] But they're doing it because they're trying to, you know, won't somebody please think of the children type of thing?

[00:06:08] An overreaction to a real valid need, which is to keep kids away from it. I don't agree that the answer should be that we completely violate your privacy. I believe that's a parental failure.

[00:06:23] We have tons of parental controls all over technology that allow parents to keep their kids safe, but parents don't want to do that.

[00:06:32] As a result, the rest of society gets punished for these things. And there are people out there that may want to access that content, and I feel that they should without having to violate the privacy to get to it. Because they're these kids, parents can't be bothered to parent their children properly.

[00:06:48] So when Robert Kennedy puts us out, says, okay, it's off the schedule, people may not understand the real flack and why when a vaccine is not on the schedule, it means it's. It's no longer free, quote. And I say free and quote, because obviously taxpayers, you're paying for it, but I'm saying out of pocket expense, it's no longer free in that regard. You don't get it through, you know, some of these medical. Your insurers won't cover it and these things you expect to pay for it.

[00:07:17] When I got shingles, I had. First I had the symptoms, which was just extreme pain that I felt. Okay, maybe I just pulled something, sprained something, whatever. And then I saw the, you know, the little bubble wart show up on my arm, and that told me something was probably wrong. And then I did the telehealth thing, and he's like, yeah, you. You got shingles for sure. Here's the prescription for. There was like, Some pills and some antibiotics, I think it was, and some cream to put on it.

[00:07:48] I don't know if any of it helped, frankly, because it certainly didn't feel like it. But the point is, I had to pay past. I think it was. I think I got like, two doses, two refills, I think that were. That were included in a plan that I had signed up for that I didn't remember signing up for. But they had a record of it because it's all tied to your social right. So after the two I had to pay for the other ones. I didn't mind. They're cringing, you know, it's like, yeah, it's 50 bucks, I guess. Fine, whatever. It's not a big deal because I needed it. It's like, if that's going to help make this pain go away and stop me from struggling all the time, let's get this done, because I can't deal with this.

[00:08:29] So there's.

[00:08:30] With this vaccine thing off the schedule, people are gonna have to pay for it. I saw a responder, and he said something like, why are you taking away women's choice? Because pregnant women were one of the populations. Why are you taking away women's choice? And why? And it's like, choice was never taken. You just have to pay for it. You just don't want to pay for it. Choice is never taken. You can always choose to take any vaccine you want. You can choose to take any medication that is offered over the counter. You can choose to request any medication a doctor has the right to refuse ethically. But you can always get vaccines that you feel that you want as long as your care provider is willing to issue it and you just have to pay for it. It's not about choice. It's no longer free. Newsflash was never free to begin with because your taxpayer money was funding that business.

[00:09:18] So part of the beef people had with that is it didn't prevent Covid.

[00:09:24] Even though Biden went on the air and said, you're okay, you're not gonna. You won't get the. He said that, but it wasn't true. You still caught it, and in some cases, you caught it more frequently than those that didn't get it. Thus, there was a question about whether it's even worth doing, which is what caused Robert Kennedy to do what he did under the Trump administration. I'm telling the story about why that's a thing. It became a thing because they're now level. Setting back to this idea that it's a conversation between you and your care provider as to whether it's appropriate. But because it's not on the schedule, it means you have to pay for it. If you do want it, your insurer is not going to cover it.

[00:10:01] So then some are really up in arms about this because of the expense. Right? It's another added expense on people. And that's why I'm talking money, because that got me thinking.

[00:10:12] People may not understand and or they understand, but simply don't like where we've come versus where we were. Let's circle this up here.

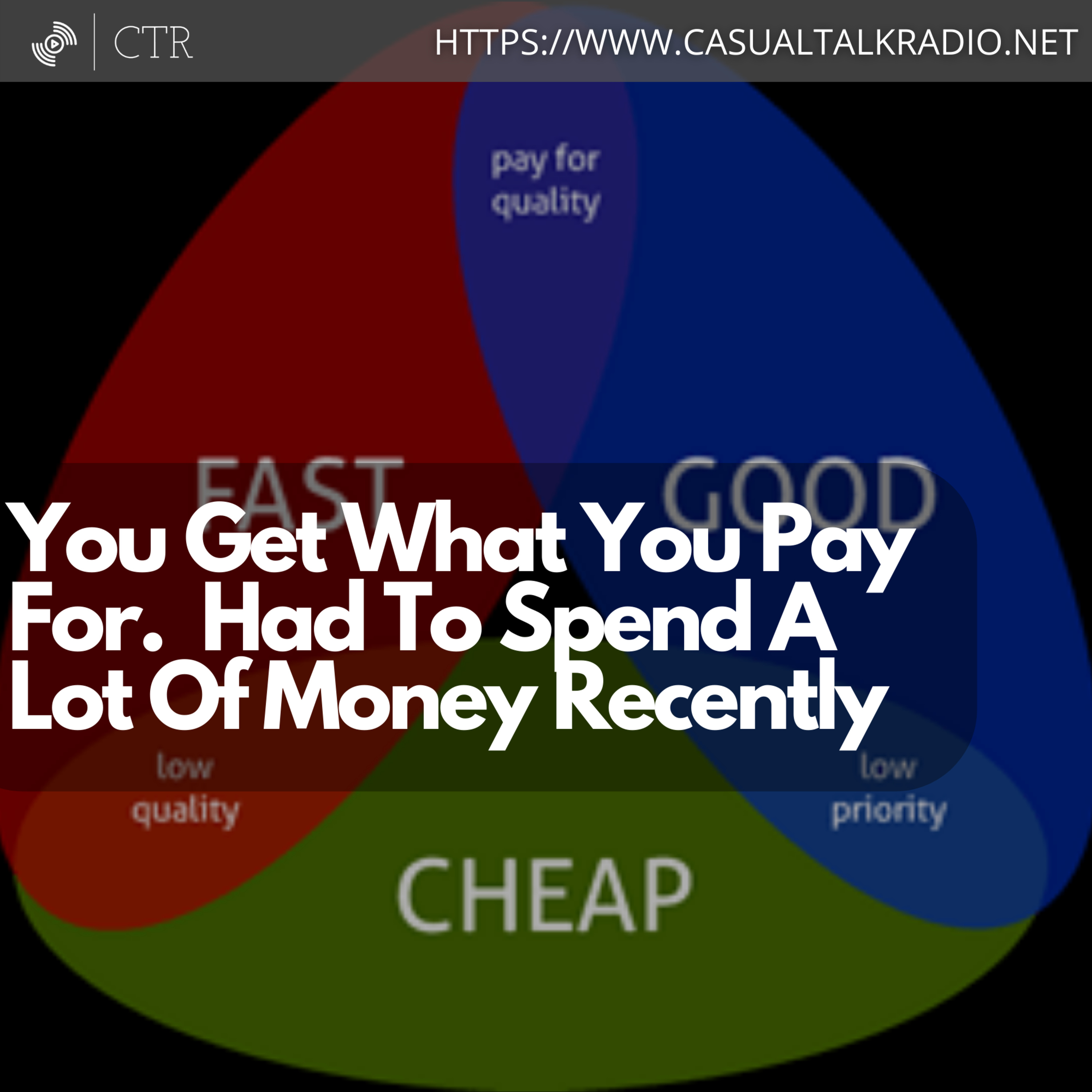

[00:10:24] When we talk about money, we have to talk about two things. There's discretionary and non discretionary. Discretionary means I choose to spend it. Non discretionary means I don't have a choice in the matter. Your taxes are a non discretionary expense.

[00:10:39] Food is arguably a non discretionary expense. Your utility bills are arguably a non discretionary expense. Your property taxes, if you own, your rent, if you don't own these, are arguably non discretionary expenses. Your car payment.

[00:10:54] You might be surprised to hear me say I would make the case that your car payment is a discretionary expense.

[00:11:04] It's discretionary in the sense that you don't necessarily have to have a car payment. You could arguably buy a little piece of garbage car, but then all you're doing is shifting the cost burden to repairs and upkeep and maintenance. Choosing to maintain a payment is the decision that you make. And you make it either because of when you did right at the time it made sense and you didn't know what else to do. Maybe it's your first car, maybe it's your replacement car, but you chose to do that because you could have gone a different way. You could choose to do an Uber all the time, but obviously that gets crazy expensive to the point it would end up being more expensive than having a car. Now the funny part of that, we're at a point now where car payments are so high that for some people it might actually be cheaper to take an Uber, depending on distance, depending on available drivers and the location in some places. If you could do an Uber, let's do straight math and I'll prove it to you. If you could do an Uber for 20 bucks, right? That's two way. So one way 10. One way 10 for 20 bucks a day. If you could do an Uber, let's assume business days. Okay, so 20 bucks a day. Okay, 20 days, 400 bucks a month.

[00:12:23] Am I oversimplifying this?

[00:12:26] Yes. Because in the real world, if we know that it's Higher than that. We know that it doesn't necessarily stop at, you know, 20 bucks. Sometimes it's 30, sometimes it's 40. Depends on surge and everything else.

[00:12:42] But let's assume, just for sake of arguments. Sake, right. That you could do 20 bucks a day for 20 days. That's business days to and from work instead of doing a car payment.

[00:12:56] News indicates that the average car payment these days is somewhere in the realm of 500 bucks a month.

[00:13:03] So that means you would save money by doing Uber. What do you lose? If you had to pick up kids, that goes away. If you have to go shopping, that largely goes away. There's all sorts of discretionary things and non discretionary things you no longer can do. Well, if you're a single person, so you have no kids and you're single and you, you don't need to do a lot of those non discretionary things and all you have is discretionary things. You have to figure out some other way to make that happen. So you could do delivery services.

[00:13:33] Well, those are crazy expensive. But you might find that it's still cheaper than doing a car payment. That's why I call it discretionary. Because if you were to break down the numbers, you could probably figure out that the car payment is burning a hole in your wallet if you'd recently bought a car because cars are blatantly overpriced.

[00:13:53] The other piece that people don't understand is a lot of people have wasted time and money on subscription services. You know, the Netflix's Peacocks, the Disney's ESPN and all these subscription services that you have opted into simply because of one or two TV shows that you want to watch or maybe you're doing it for your family. But we know that the vast majority of the time you're only watching maybe four or five shows and you're getting ripped off. And the cable companies, when they went to those to streaming instead of the hard cable service, they never did adopt. True. A la carte. So you're paying for some plan and let's say it's 50 bucks a month or something for a couple of channels, you're getting ripped off. That's what it is.

[00:14:37] The industry pushed towards mobile phones. It might surprise you to learn that a regular VOIP, VOIP look line, I have a VOIP line, it arguably costs me maybe, maybe 50 bucks a year for to maintain that line.

[00:14:56] That line handles phone calls. I can receive the call on my tablet. I can do pretty much anything you can do with a mobile phone. But I do not have A monthly plan that many of you have that's exceeding 80 bucks a month, all just for the privilege of being able to do some phone calls and text messages.

[00:15:17] And a lot of these services are forcing you to use mobile phones. They're taking away call boxes, they're taking away pay phones, or take away all these other things to where you're basically forced to have some measure of connectivity.

[00:15:31] Now, the difference between yours and mine is yours. You can take it anywhere. Well, what if you don't go a lot of places? Like, I don't. I don't need mobile. That's why it's called a mobile phone. The intent was, it was for when you're out and about. When you're home, you would use the home phone because that's what it's for, that's what it's there. Instead, they sold you on the narrative of just having the mobile phone do everything. And that's fine if you're cool with it. I simply was not. As a result, there is no such real thing as a phone bill for me. It's a fraction of the money that I spend because I was smart enough to avoid falling into the trap that is mobile.

[00:16:11] For the infrequent times, I do need mobile access, mobile data.

[00:16:16] I use a prepaid service. The prepaid service, I remember I topped it up before I left Nevada to just to cover myself, and that was $300. I just cashed cash, walk into the store, hand them 300 bucks. They top up the account, right? And then it takes from that pool, but it's prepaid. They don't even have any contact information because they don't need it.

[00:16:40] So I would say for that, give or take, and I can change the plan how I care to. So the lowest it might be would be 30 bucks, but I'm not required to pay it. There's no credit impact if I don't pay it. The only thing that would happen if I don't is pay it is I simply don't have access to mobile service, which I don't need unless I'm out and about. So if I'm going somewhere, I can quickly top up that account, and I could do that through multiple services.

[00:17:07] And in some cases, I can pay cash to do it, walk to a store and give them cash and top it up. Or I can use various payment methods to top it up and just give the phone number and it tops it straight. So I can do it one off. I can say, all right, well, I know I'm about to do Some stuff here I can book a one time 30 bucks and never have to do it again or not for another four or five months. So my, my point is my overall telephony bill is a fraction of what yours is.

[00:17:37] Where I spend a lot of money is on Internet because I have a lot of Internet consuming devices that require high speeds. As a result, the quality of things like the podcast and my work with my client and everything is top notch because I invest in something that is of value. The Internet also powers the VoIP line, so it's absorbed into the Internet service. When you go all in on mobile service, you can try to use just nothing but mobile for everything that you do, like all your Internet stuff if you want to, that's cool. But of course you have what caps, you have throttling, you have all these things that the providers have done to try to make it a, you know, get money out of you. And I wasn't going to play that. Whereas when you do the regular landline Internet service there is usually no data caps or if they have some, they're extremely high. I have no data caps online. So my investment to the Internet paid off in the long run because I can use it as much as I want. Where you cannot do the same on the phone side, the mobile side, unless you pay for the super high plan. If you pay for the superior plan, that's fine if you want to do that. But again, the downside is you are then tethered to something that if you don't pay it, your credit is going to get screwed. I don't have such a problem.

[00:18:53] So everything I broke down is not in point of criticism, it's simply to break. It's simply to tell the story that there's multiple ways to think about money consumption. I then cross reference that with an article I read in Epic Times that was talking about making your money go further.

[00:19:09] And as I close I wanted to share some of the thoughts that are here and my how I feel about what they're talking about.

[00:19:16] The first thing they talk about is automation. And I'll tell you, the one thing I don't do is auto pay. Auto pay is the biggest scam. When we talk autopay, we're talking about letting the provider, whichever provider, pull money out of your account whenever they feel like it. What happens if you lose your job? What happens if the money drains?

[00:19:35] Okay, that money, they're going to go after it and when it's not there, they're going to jack up your credit. In my opinion, the Auto is actually to your detriment because it makes the assumption you're not going to lose your job. Now, I'm a contractor. I own my own business. I'm talking regular nine to five workers, eight to five workers. I would rather. And what I do is I know when bills are due. I signed up for E billing, so it notifies me there's a bill that needs to be paid, tells me what the amount is.

[00:20:03] I purposely go into my bill pay service and I book payments to those different things. And it's controlled. I see how much it's owed, I know how much is in the account, and I'm the one triggering payment. And I push it to them. I don't allow them to pull it because it allows me to make sure the money's actually there. And if it's not there, I can make moves to actually get money there so that I can make sure that everything's working the way it's supposed to. In my opinion, that's more controlled, it's safer, it's less risky than the alternative, which is letting them pull whenever they feel like it. You might disagree. And you like auto pay. Great. I think auto pay is one of the biggest ways people fall into a trap. Speaking from experience, when I did do auto pay and then, you know, Covid hit and I lost my clients and I saw how bad it gets quick. When you cannot rely on that steady stream of income. That works great. When you have a. It would work fine for me because I make a lot of money, but I've trained myself not to fall in that trap. I think it's a trap and I think it's dangerous. Personal opinion, it talks about telling your bank to automatically shift money to your savings account.

[00:21:12] Most banks recommend doing that. Like they'll say, set up a savings account, set up a checking account. You can link the two and you can set up, schedule transfers and do that. And it makes it's. I'm not against the concept, but once again, that makes the assumption of steady stream of income. And the one thing the banks don't do is, is allow you to schedule contingent on a deposit. Meaning there's a rule. There's a complex rule. If there's a deposit greater than X, do this transfer of Y. None of the banks I've dealt with let you do that. They just say, transfer this on a certain date. Well, no, I want it contingent on a deposit. If the deposit's not there, you don't transfer. Because unless the money's there, I'm not going to let you do a transfer.

[00:21:57] So I don't do this because the money I can't control when I'm going to get the money. I get emailed the day before. So I know when it's coming, but I can't control when it's coming. I would love to have a bank, and if anybody knows of1casualtalkradio.net hit the contact form. But I would love to have a bank that lets you drive a rule, a smart rule that says, assuming there's a deposit of X, go ahead and transfer Y. That's what I want.

[00:22:22] That way I can safely do it and I can fluctuate. Let's say it's a percentage. Okay? If there's a deposit of x, send 20% of whatever the deposit was. So if there's a deposit greater than $500, right, send 20%. Okay? So deposit comes in, it's 1,000 bucks, right? So it's going to send $200, and I'm okay with it. If a deposit comes in, it's $500, it's going to send $100, and I'm okay with it.

[00:22:48] Not fix dollar amounts and not without the contingency about a deposit. Because the deposit is the key to making sure it's okay to do that. In my personal opinion, anyway.

[00:22:59] It talks about using, you know, when you go shopping.

[00:23:02] One of the big things that happened with shopping was this rise of things like Costco, you know, buying in bulk.

[00:23:08] What I learned, and this, I learned this with avocados.

[00:23:12] I tend to not finish certain foods that, that spoil quick.

[00:23:18] So you can do dry foods in bulk, you know, used to big bags of toasted oats or something. But when it. And canned, sure. But then I get tired of canned food. And this is my other problem, personal problem.

[00:23:32] I tend to get tired of certain foods quicker than I think I should.

[00:23:37] So I used. I, this was a bad, like, I would go, okay, today I got a craving for Jack in the Box. Then I got a craving for McDonald's. Then I got a craving Burger King. Then I got a craving for Car Barrels. Then I got a craving for Arby's. Then I got a craving for Mexican. Then I got a craving for Italian. Then I got a craving for candy. Like, I, My, my palette shifts to some degree. It still does. Like, I. Today I was gonna get some chicken. I just, for whatever reason, had a craving for chicken. I had to fight it. But then it's like, okay, do I do Chick fil A? Do I do Culver's Do I do something else? I wasn't going to do kfc, there's, there's a Popeyes, but they don't know what they're doing. There's not a churches out here. So then I got to be picky about the chicken, right? It's certain chicken tastes good. You know, we have a canes, raising canes that's down, but they don't deliver. So I gotta go down there. Do I do that?

[00:24:29] And you might think that's picky eating. Yeah, that's my flaw. It's. I can't. That's how I. My palate is. It's it. Okay, first, what do I want to eat? Second, within what I want to eat, I gotta choose if I want a burger. There's so many selections and I don't like the same burger twice in a row. And certain ones I can't stand anymore, like McDonald's.

[00:24:47] So from a cost control perspective, it's difficult for me. And I often will just go without and I'll get canned foods like chili or something, and it's fine. But then I get tired of it.

[00:25:00] So what their suggestions, Buy in bulk. And I struggle with that. You might be okay with it, but I struggle with that because it either goes too bad too quick or there's just. You buy so much that you end up, you know, it's, it's just not eaten. And that's happened as well. And I don't like that either.

[00:25:18] The, you know, this other one I'm, I'm shaking my head at, not because it's wrong, but because it's not as simple as they make it seem. So it's talking about, you know, we lost Hollywood Video, we lost Blockbuster Video and some of these other ones. So it's hard for us to rent a movie like the old days.

[00:25:38] Now you pretty much have to commit to a subscription or watch the movies like a Netflix garbage.

[00:25:43] Those subscriptions are a waste of money flat out. But they're basically the only way that you can do that. You can't just simple try stuff like you could before, which I thought was much more cost effective because unfortunately the industry has moved away from physical. So what it was talking about is things like borrow before you buy. Right. And you might not know, but libraries, they have more than books. They have like music. They'll have like some of them, not all, but they'll like music, they'll have like Blu Rays. Other things that you can try before buying. The flaw is that the library only has so much space to work With, So they're not going to have every single possible thing that you might want to try. Where I felt like Hollywood had a little bit everything. They even used to have the little side thing with a curtain, right?

[00:26:29] But Hollywood had, like, everything. Blockbuster had, like, everything. And the loss of those limited our ability to really borrow. At this point, you pretty much are stuck just subscribing or buying. So, like, I just bought, you know, a book on. I think it's Mary Wells, you know, because I don't have a choice. I could have borrowed it, but libraries don't carry books like that, at least not the one I was specifically looking for. So that's a struggle. The other thing it talked about was, you know, if it's something you think you want, wait 30 days.

[00:26:59] The flaw of that is if you want it and you're thinking about it now, there's two things to think about. A, do I have the money to do it? And B, do I need it now? Right. If I need it now, waiting 30 doesn't make any sense. If money's tight, waiting 30 might not make sense. So there's a sound logic in the sense of avoid fomo, you know, hold off, don't let the FOMO pass. Because maybe it's just one of those passing things that's. I've gone through that, you know, some. I look at something, it's like I will eventually get it, just because if I. If it's something I say I want, there's a solid reason why I think that.

[00:27:38] And so at some point, I will get it. It just takes time. And it's whatever the money's available. I'm dealing with that with the contractor right now.

[00:27:46] Now, let's talk about the utility bills, because it made some good points here. Some are good points, not all, but it was talking about using smart power strips. Absolutely. Smart power outlets and plugs. Absolutely unplug when not in use. Sounds good, but sometimes it's not really practical.

[00:28:03] Thermostat programmable. One thing that drove me nuts when I was renting these, you know, none of these places and even the house I was renting, they just would not put smart thermostats in the thing. So they force you to go and they'll constantly run on a cycle that's not energy efficient.

[00:28:20] And then you have to go and manipulate it to get. To stop doing what it's doing. Just get a smart thermostat. I think that should be the default. Now we. We press on smoke detectors. To me, a smart thermostat should be a default, just like the smoke detectors. That's my personal opinion anyway on that business.

[00:28:36] And then it was talking about the energy company, right? Sometimes if you let the energy company control your thermostat, they give you like rebates or if you do energy efficient things, they'll do like rebates. The downside is they may want you to do like energy assessments and all these hoops to jump through to get it. That's the scam. So I don't do that, but I share it as an opportunity. But that's not really going to save you too much money in the long run. You'd have to invest thousands of dollars to get any sort of return. And at that point the return on investment is slim unless you're done with an older home. Some other items they brought up were, you know, there's apps that you can install to do market research, there's survey type things that compensate you for the survey. I was doing that actually when I was, when there's Covid. It was tough and I had to get something because there was a point where like I said, my diet consisted of mustard.

[00:29:29] So please, this one is a good one, you know, if you're looking. But I would only do it if it was something where you desperately need the money because you're giving away a lot of information, private information, and I'm never a fan of it unless you're just at wits end. You got to do something. But there are again those apps that are doing, doing that online and they do compensate you for them. The compensation is not stellar, but they are decent money. You know, you can make a couple bucks per do quite a few of them. Of course anybody can be a gig worker. As long as you have a vehicle, you can be a gig worker. So you can sign up if you don't have a, you know, if you have a clean background, you can sign up for UberEats, you can sign up for Lyft, you can sign up for Grubhub, you can sign up for DoorDash and do those types of deliveries. Newspaper deliveries are still a thing. You can sign up there. And again you just have to have some form of transportation at the end of the day and a clean background check and they'll let you do that and then you're compensated. So there's all sorts of other ways, side hustles that you can do to earn a little bit of money to offset, you know, some of the expenses that you have or maybe you have some sort of vice that you just can't let go of and you want to be able to fund that.

[00:30:39] This is a way to not have it come out of your regular JLB salary.

[00:30:44] Some other stuff about credit, right? You might have an interest rate opportunity if you've been paying well on a card or for a mortgage or your car.

[00:30:53] If you've been a good, studious monthly payer, consider contacting the lender. Just ask about an interest rate change or decrease and they may be able to accommodate you. It's not guaranteed, but you might be surprised. Sometimes they're open to it, especially if there's a new program that they can roll you into or you might be able to refinance something to get a lower rate balance transfers. Speaking of credit, I've said credit's a scam, because it is. I would recommend avoiding credit cards. Sometimes you get in this position where you can't. But I would try to figure out how to avoid credit cards because credit cards are the easiest way to get into traps because you spend on them with the intent of paying it back and you're paying back over time, but the interest that you pay is just taking money from you, number one. Number two, depending on how much credit you extend yourself, your debt to income ratio gets affected. Because you know they're going to extend you a credit card and it's really not based on how much money you make, it's just based on your credit at that time. And then over time they may give you credit increases. But the big picture is that you have to be, you have to be very careful how much credit you extend because if you extend too much, you'll overextend yourself. And again, the interest is just chewing away. There are people who make enough money, you know, let's say you have one card that's for gas or something. I had that. I had a, during the pandemic, I actually had a gas card. It was a Shell, I think it was card and that's all I had left. So I was using it to get food at the local Shell station until I couldn't. That's, that's a viable use case. But then you got to think about, okay, how am I going to pay this thing back when it, when this all passes? So I, I say try to avoid the credit card trap because it is a trap. Sometimes you can't. Like renting a hotel, you know, they don't like debit cards and they won't take cash unless you're going to a sketchy speakeasy kind of hotel.

[00:32:51] Renting a car. They refuse to rent a car to you for debit cards, which is stupid, but they refuse to do it. They want a credit card.

[00:32:58] So I'm not suggesting there's not viable use cases. I'm saying try to avoid credit cards as much as you can because they're just going to put you into a trap.

[00:33:06] And again, the interest rate change is a very good question to ask because it can't hurt to ask the question. All they can say is no. Right.

[00:33:14] The big picture though, everything that I talked about, you know, the optional subscriptions, the Netflixes and the Peacocks and the Disney's and ESPN pluses and all these subscriptions, the mobile phone plans where you know you're getting ripped off on those things, having to stop at Starbucks every morning for your upside down soy chai latte with extra cream or whatever that is.

[00:33:37] And that's expensive. All of these things build up, they add up to extra expense that you can control.

[00:33:46] And it's a vice, it's something that you have to choose to control.

[00:33:50] If you don't choose to control, you're going to put yourself in a hole. That rhymes. And a lot of what you're experiencing inflation just makes worse. But I'm suggesting that the trap is really self imposed.

[00:34:04] They've created all these vices and you've fallen into it and you run with it and it's simply taking money from you. Irrespective of the inflation situation. All these things have trapped you because it's a vice, it's a something, it's like a drug. You know, smoking is another vice, alcohol is another vice, weed is another vice. There's all these that they're just taking money from you. Sometimes you say, well there's a difference between what I, I want to spend that stuff. Exactly. Discretionary versus not. If it's discretionary, you control it. So if you're struggling financially, the discretionary is what you have to look at. The non, you don't have much flex.

[00:34:45] And some things you may have to sacrifice. That may mean telling your kids to sacrifice. That may mean not buying your kid a smartphone because they don't need it versus books for example.

[00:34:55] That means telling your kid no when they want a video game. That may mean telling your kid that we can't go out to the park, to the like Disney or something, that we may have to go to something that's a little bit less expensive if not free. That means you may not be able to do pizza night every single weekend. That means things have to change, right?

[00:35:14] And it's hard. I'm not suggesting it's easy by any means. I'm suggesting that if you are struggling financially that you have to train yourself to work within your means and live without and do sufficient to where you can survive.

[00:35:30] Some people like doing that, some people don't like doing it. I simply suggest that it's necessary in the world we're in.

[00:35:36] Once again though, if you have any concerns you can always contact us and we'll do the best we can. But we can't tell you Zach's specific situations. All we can do is suggest and our suggestions are based on trial and error, failure, success at times and again we don't know what the future holds. That's why we share it now because we simply don't know what will happen and we hopefully this that we're talking will stand the test of time and last long after we're gone.

[00:36:09] Oh oh oh oh.